A Biased View of Lamina Loans

Table of ContentsThings about Lamina LoansExcitement About Lamina LoansLamina Loans Fundamentals ExplainedGet This Report about Lamina LoansThe smart Trick of Lamina Loans That Nobody is Discussing

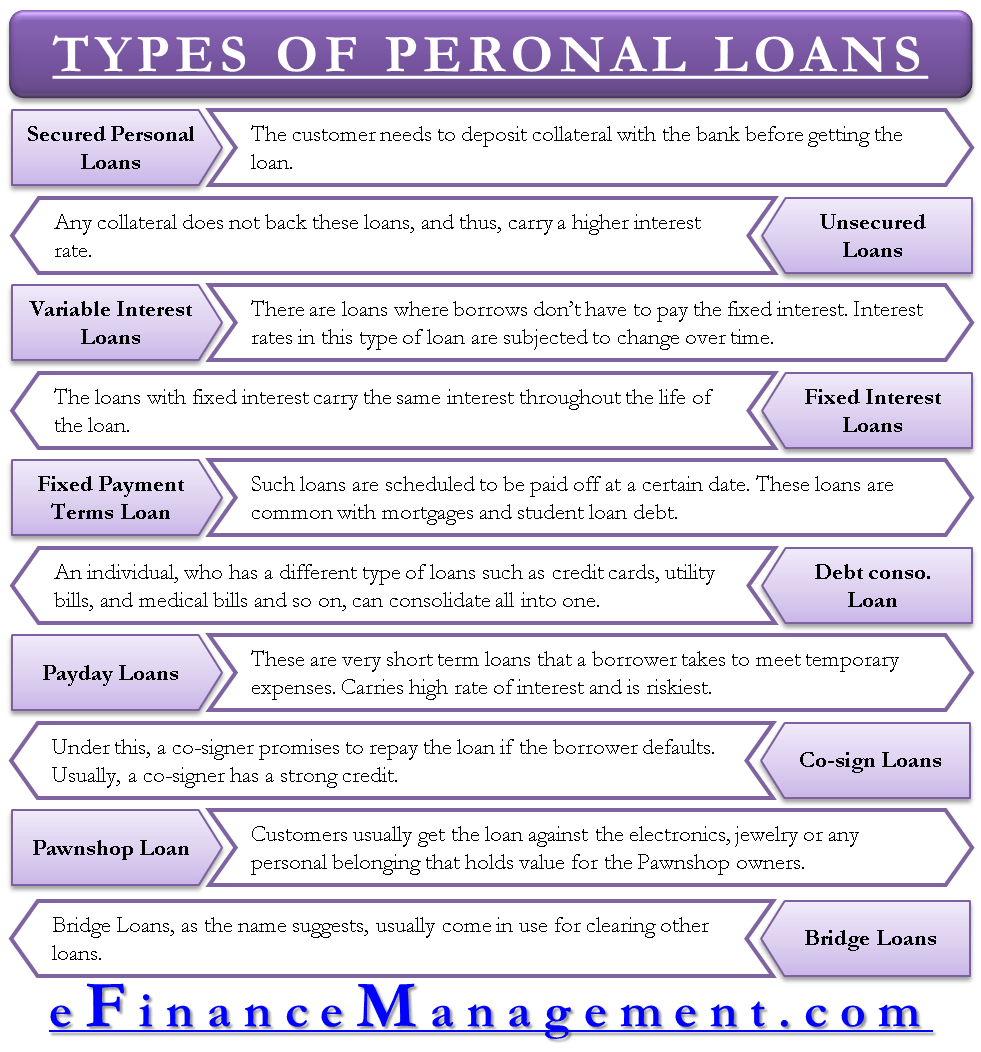

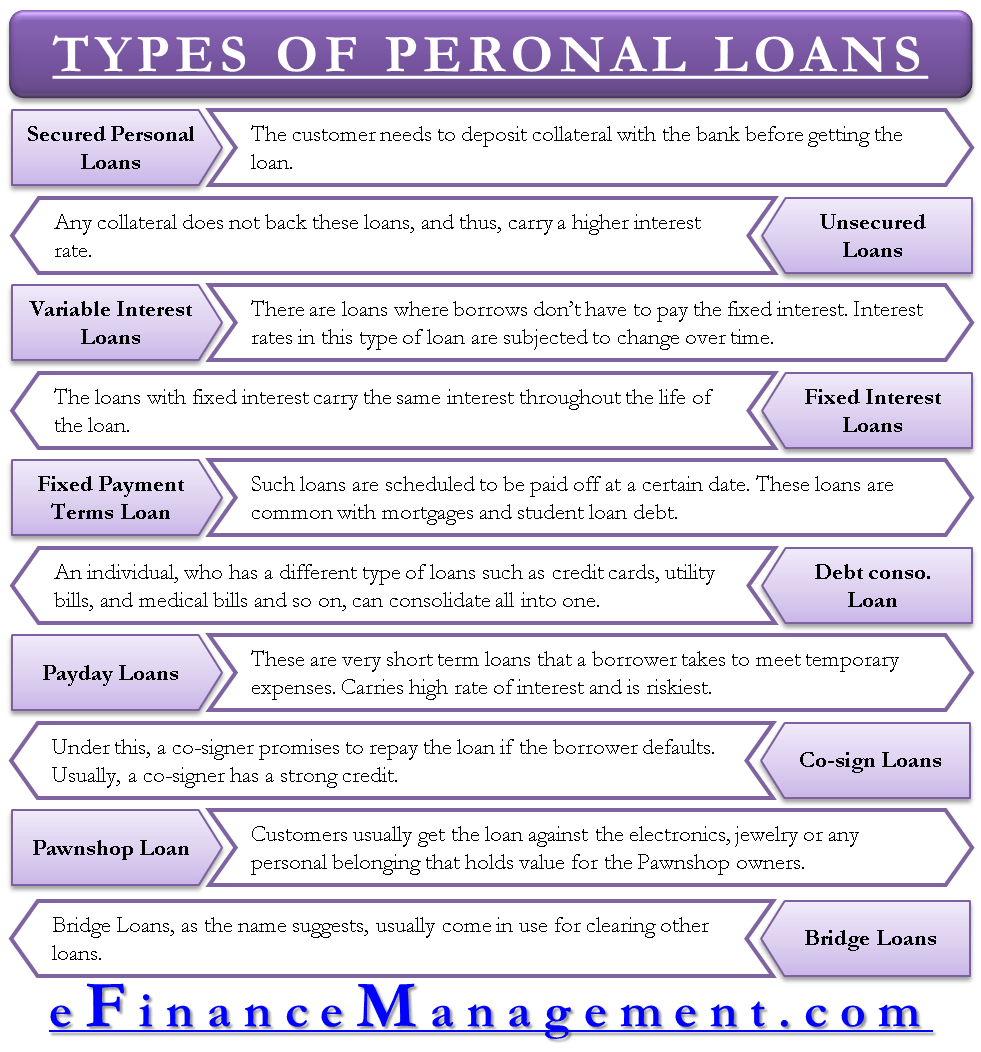

If you're looking for a long-lasting lending (like over the program of the next decade), a variable rate of interest car loan could not be best. When you obtain a funding, you normally require a great credit rating as well as income to show you're a dependable candidate for a lending. If you don't have a solid credit background, you may need to find somebody else that does.A cosigner is somebody who can vouch for your credit reliability. A cosigner's credit report can protect you a car loan when you wouldn't otherwise qualify. Whether you need a cosigner to qualify or otherwise, getting one can secure you a reduced rates of interest if they have far better credit than you. While paying your loan promptly can improve your credit scores (and theirs), not paying it back promptly could create your credit rating and also theirs to drop.

Contrast rates from several lending institutions in 2 minutes Regarding the writer Dori Zinn Dori Zinn is a student financing authority and a factor to Reliable. Her job has appeared in Huffington Blog post, Bankate, Inc, Quartz, and a lot more.

A (Lock A secured padlock) or implies you have actually securely connected to the. gov web site. Share delicate information only on authorities, protected web sites.

How Lamina Loans can Save You Time, Stress, and Money.

A finance is when an amount of cash is offered to another party or individual, typically including rate of interest as well as various other costs, in exchange for the future repayment of the car loan. When the customer takes on the lending, they accept a collection of terms that could consist of rate of interest, finance charges, as well as repayment dates.

Fundings are a type of financial obligation, as well as lenders will certainly review your credit reliability, normally including factors such as your credit report scores and records, before offering you a loan with its affiliated financing terms, consisting of rate of interest. The much better your credit rating, the more probable you'll be provided a lending with far better terms.

Initial info concerning the various kinds of plastic cards available, covering credit rating cards, shop cards and fee cards, and also prepayment cards. Lamina Loans. Details about exactly how hire acquisition and conditional sale contracts function, the right to end a hire purchase arrangement and what occurs if the customer is unable to pay. Things you can do to aid take care of or pay off your overdraft account.

Covers credit history brokers and also the charges made for their services. Info concerning buying things from a brochure and also being an agent for a catalogue business. Info concerning what a pawnbroker is and also what takes place if you are unable to settle your lending, lose your ticket or do not collect the products.

Some Known Details About Lamina Loans

ARM fundings are generally called by the size of time the passion price remains fixed and how frequently the rates of interest goes through modification after that. In a 5y/6m ARM, the 5y stands for a preliminary 5-year period during which the interest price continues to be dealt with while the 6m reveals that the rate of interest rate is subject to adjustment once every 6 months after that.

These financings often tend to enable a lower deposit and credit scores score when contrasted to standard loans.FHA finances are government-insured finances that might be a good fit for buyers with restricted income and also funds for a deposit. Bank of America (an FHA-approved lender) supplies these finances, which are insured by the FHA.

The Ultimate Guide To Lamina Loans

Peer-to-peer (P2P) financing works by matching debtors with lending institutions via P2P loaning platforms. These platforms function like industries combining individuals or companies try this that intend to offer cash, with those that want a funding. Depending upon the platform, you might not have the exact same security as when you borrow in various other methods.

A term car loan is simply a loan attended to service functions that needs to be repaid within a specified time frame. It commonly brings a fixed rate of interest, monthly or quarterly settlement routine - and consists of an established maturity day. Term fundings can be both secure (i. e. some security is supplied) and unsafe.

An over-limit facility is considered as a source of short term financing as it can be covered with the next down payment. Lamina Loans. A letter of credit score is a file released by a banks guaranteeing settlement to a seller supplied certain papers have existed to the bank. This makes certain the repayment will certainly be made as long as the services are carried out (generally the dispatch of products).

Not known Factual Statements About Lamina Loans

At the conclusion of the leasing duration, the lessor would certainly have recovered a big section (or all) of the preliminary price of the determined property, along with passion earned from the leasings or installations paid by the lessee. The lessee also has the alternative to acquire ownership of the recognized asset by, for instance, paying the last rental or installment, or by negotiating a last purchase cost with the owner.

This is usually a business funding used to SMEs and also are collateral-free or without third party guarantee. Right here the debtor is not called for to give security to avail the lending.

This car loan facility is supplied to firms with greater than two years of company experience, existing owners of at the very least 2 industrial automobiles, restricted consumers and also carriers (Lamina Loans). It is necessary to note that these are only general descriptions. Lenders have their specific lending examination as well as paperwork criteria before a financing decision is taken.